Arkam Ventures, has announced the launch of its Fund II with a target corpus of $180 million to back technology-targeted to startups. The Early-stage venture capital fund corpus goal will be achieved by attracting participation from top-tier global institutional investors and family offices for investments, according to a company statement. The company partners with limitless founders innovating to transform the largest markets in India.

Fund II will maintain its emphasis on the “middle India opportunity” and endeavor to develop technological solutions for the next 400 million Indians, propelled by the process of digitization. The recently established fund intends to support a diverse portfolio of 20 startups, spanning both established sectors and emerging ones such as manufacturing technology and electric vehicles.

Rahul Chandra, Managing Director at Arkam Ventures, revealed “As a team with 20 years of venture investing experience in India, we believe that the defining themes for the next decade will be the untapped Middle India market, rapid scale, and capital efficiency,” said .

Chandra added, “Arkam’s “foundation-first” approach helps portfolio companies create sustainable businesses with the right governance, organisational design and go-to-market strategies.” With the new fund, Arkam will back startups across Series A and Series B stages. It will also deploy capital in strong portfolio companies for follow-on rounds. The fund will also bolster its portfolio advisory function focused on organisational design, go-to-market (GTM) strategy, finance and operations, said the statement.

Arkam Ventures Fund II focus on untapped India Market

Arkam Ventures invests across two major themes. These are generational themes with massive market drivers, innovation proof points, and clear opportunities for digital disruptors to reshape large industries or create new ones.

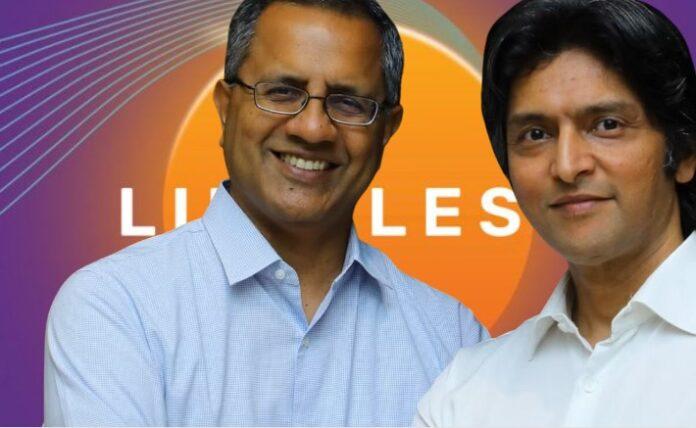

Arkam Ventures was founded in 2020 by former Co-founder and Managing Director at Helion Venture Partners, Rahul Chandra, and former Partner at Kalaari Capital, Bala Srinivasa. In April 2022, it announced the final close of its $106 million Fund I, which has backed 16 startups including fintech startups Jar and KreditBee, food and agritech companies Jai Kisan and Jumbotail, skilling companies Smartstaff and CUSMAT, as well as SaaS startups SpotDraft and Signzy.

The firm’s first fund includes British International Investment, SIDBI, Evolvence, Quilvest, and others as limited partners.