In the dynamic landscape of Indian startups, intense competition has become a catalyst for soaring valuations, raising pertinent questions about whether these enterprises are genuinely overvalued or simply immersed in fierce competitio

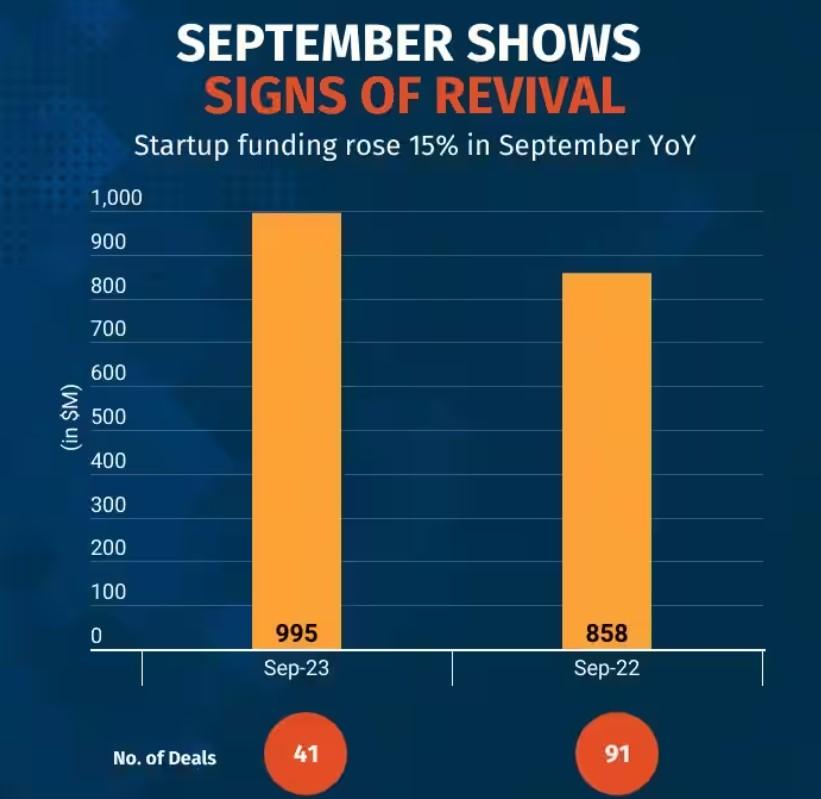

Funding for India’s startups witnessed a robust 15% surge in September’ 2023 compared to the same period last year. This uptick in investment activity brings a glimmer of hope to the nation’s third-largest startup ecosystem.

Data compiled by Venture Intelligence revealed that Indian startups secured close to a billion dollars in funding across 41 deals during September, a notable increase from the $858 million raised through 91 deals in September 2022. Furthermore, the month showcased three substantial deals exceeding $100 million each, collectively propelling the funding amount to nearly $1 billion.

Indian Startups Funding Surge 15% in September, Signaling Recovery

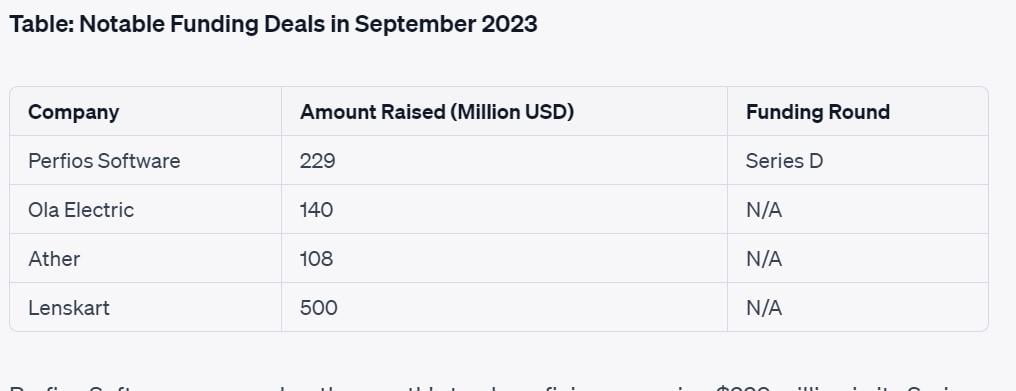

Perfios Software emerged as the month’s top beneficiary, securing $229 million in its Series D funding round from private equity firm Kedaara Capital. The substantial funding rounds of Ola Electric and Ather, each raising $140 million and $108 million, respectively, underscored the sector’s vigor.

Navjot Kaur, Partner at Epiq Capital, a prominent late-stage investor, commented, “India’s digital space presents a vast opportunity, and venture capitalists are well-endowed with capital. The current investment pace may seem sluggish, but it’s not due to a lack of funds or opportunities. It hinges on performance and pricing alignment. Once these factors align, we anticipate an acceleration in investment.”

The average ticket size for deals also exhibited significant growth, doubling to $24 million in September 2023 compared to just under $10 million in the same period last year.

Despite the resurgence of late-stage deals, early-stage funding experienced a dip in September, with only nine startups raising $10-35 million in funding rounds over the past two weeks. Venture Intelligence data indicated that early-stage (Seed to Series A) startups raised $75 million across 19 deals this month, down from $191 million raised across 59 deals in September 2022. While this marked an improvement from the previous month, the funding value remained considerably lower than in June and July 2023.

Apoorva Ranjan Sharma, Co-founder and President of Venture Catalysts, shared insights on the matter, stating, “Investor sentiment is a significant factor behind the reduced funding for early-stage startups. Currently, overall sentiment is subdued, leading to decreased investments. Some investors are also drawn to other thriving asset classes like the stock market and real estate. Nevertheless, startups demonstrating strong financials or exceptional growth prospects will continue to attract funding.”

Despite the September surge, overall funding for Indian startups in the first nine months of 2023 remained substantially lower than the previous year. Between January and September 2023, startups in India raised $5.9 billion across 434 deals, a notable decrease from the $21.4 billion secured across 1,037 deals during the same period last year.

On a global scale, rising interest rates and stricter monetary policies prompted venture capital and private equity investors to exercise caution in their investment decisions. In India, concerns regarding startup overvaluation were voiced by investors and industry observers alike, including Sameer Nigam from PhonePe, Nithin Kamath from Zerodha, and Rajeev Misra from SoftBank.

While addressing the issue of overvaluation, Apoorva Ranjan Sharma emphasized the role of competition among venture capitalists in driving higher valuations. He also stressed the importance of startups focusing on resilience, rationalizing costs, and considering raising funds at more reasonable valuations during downturns.

In conclusion, the Indian startup ecosystem showed signs of revival in September, with late-stage deals leading the way. However, caution among investors and concerns about overvaluation continue to influence the funding landscape, highlighting the need for startups to maintain financial prudence and adapt to market conditions.