January 25, 2026: Indian startups secured a robust $302.8 Mn across 37 deals between January 19 and 23. This funding jump marks a 13% weekly increase from the previous $268.6 Mn, effectively signaling the end of the long-standing “funding winter.”

Driven by Juspay’s ascent to unicorn status and a massive $70 Mn Series B for AI startup Emergent, the ecosystem is transitioning from the cautious discipline of 2025 into a high-octane growth phase for 2026.

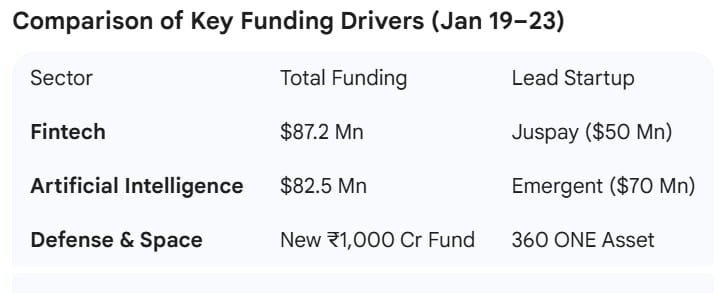

At the heart of this resurgence was Juspay, which officially became India’s first unicorn of 2026. By securing $50 Mn in a Series D round led by WestBridge Capital, the payments orchestrator saw its valuation swell to $1.2 Bn. Juspay’s ascent provided the necessary gravity for the Fintech sector, which dominated the week with four startups cumulatively bagging $87.2 Mn.

However, the shadow of Artificial Intelligence loomed large in the rearview mirror. Emergent, an AI application layer startup, snagged the week’s largest individual cheque—a massive $70 Mn Series B from heavyweights like SoftBank and Khosla Ventures—propelling the AI segment to a total of $82.5 Mn.

What the Recent Funding Jump Reveals About the 2026 Ecosystem

While the private markets celebrated new milestones, the public markets offered a sobering reality check. Amagi, the media SaaS powerhouse, made its long-awaited debut on Wednesday. Despite closing its IPO with high investor enthusiasm, the stock opened at a 12.2% discount on the BSE at ₹317. Though it recovered to end the week at ₹375.7, the “muted” listing suggests that public market investors are no longer buying into “new-age tech” premiums without scrutinizing immediate listing gains.

The IPO pipeline, however, remains undeterred. Shadowfax saw its public issue oversubscribed by 2.72X, with its debut slated for early next week. Meanwhile, the “big fish” are circling the waters; PhonePe has updated its DRHP for a pure Offer For Sale (OFS) of 5.06 Cr shares, and Reliance Jio is reportedly finalizing its own massive filing.

This flurry of activity suggests that while listing gains may be thinning, the maturity of these companies is finally meeting the regulatory and capital requirements of the mainboard.

Beyond the headlines of IPOs and unicorns, the week saw a strategic pivot toward “Sovereign Tech.” 360 ONE Asset launched a ₹1,000 Cr fund dedicated specifically to defense and space strategy, aiming to back 15–20 deeptech firms. This aligns with a broader national trend, further bolstered by the Union Government’s ₹5,000 Cr equity infusion into SIDBI to keep the credit pipes flowing for MSMEs and early-stage innovators.

The week wrapped up with a major consolidation in the SaaS space, as Wingify’s VWO merged with Paris-based AB Tasty to create a global personalization titan. With active institutional players like Fireside Ventures, Kae Capital, and Rainmatter each backing three startups this week, the message is clear: the ecosystem is no longer just surviving; it is actively restructuring for global scale.