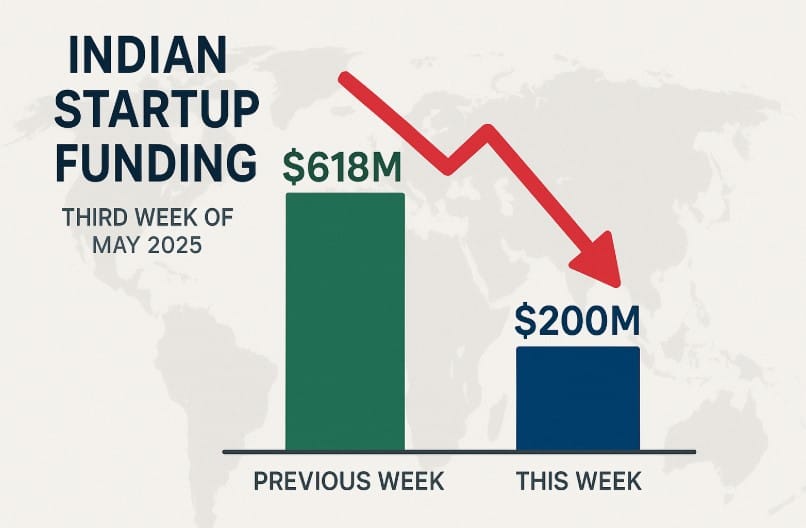

May 18, 2025: The pace of startup funding has taken a noticeable dip in the third week of May 2025 in Indian. After a record $618 million raised in the previous week, this week’s funding total dropped to $200 million across 24 deals.

While the slowdown may initially seem like a setback, it’s important to recognize that this dip comes after a period of exceptionally high activity and isn’t necessarily a sign of deeper issues within the Indian startup ecosystem. In fact, this shift might reflect a natural market adjustment as investors recalibrate their strategies in a more cautious global investment climate.

Despite promising numbers earlier in the month, the recent dip reflects a larger trend of cautious investment behavior. The $618 million raised in the prior week was a positive outlier, with this past week revealing a dearth of large funding rounds. Notably, no single investment deal surpassed $50 million, indicating a more conservative approach to venture capital in a tightening market.

As of mid-May, weekly venture funding for Indian startups has averaged between $100 million to $200 million since March, signaling a possible slowdown in capital inflows. But are these figures a cause for concern, or just a reflection of global economic uncertainty?

Investment Caution Prevails in Indian Startup Funding

The decline in startup funding is a direct result of growing investor caution. With global economic conditions fluctuating and startup valuations continuing to adjust downward, many venture capital firms are choosing to hold back. Large, high-profile deals—which had been more frequent in 2021 and 2022—are now much rarer. This marks a shift from a period of aggressive investment to one characterized by greater scrutiny and risk aversion.

For Indian startups, which have relied on substantial capital inflows to fuel their rapid growth, this slowdown might pose challenges, especially for businesses that had relied on larger investments to scale. However, it’s also important to note that the Indian startup landscape is still evolving, with new sectors showing promise, such as AI, B2B e-commerce, and SaaS.

Despite the general decline in capital inflows, several startups managed to secure significant investments. Among the standout deals was Farmley, a Makhana brand, which raised $40 million from prominent investors such as L Catterton, DSG Consumer Partners, and BC Jindal. Similarly, JSW One Platforms, a B2B e-commerce platform, secured Rs 340 crore ($39.7 million approx.) from an array of investors including Principal Asset Management and JSW Steel.

In the hygiene sector, Nobel Hygiene raised Rs 170 crore ($20 million) led by Neo Asset Management. Meanwhile, Celebal Technologies, a SaaS startup, attracted $15 million in funding from InCred Growth Partners Fund I and Norwest Capital, signaling investor confidence in enterprise tech solutions.

Interestingly, Flam, an AI infrastructure startup, raised $14 million from RTP Global and Dovetail, highlighting the growing importance of artificial intelligence in India’s startup ecosystem.

While the dip in startup funding is concerning, the long-term outlook for Indian startups remains positive. Investors are still placing significant bets on the future of AI, fintech, e-commerce, and SaaS. Additionally, the Indian market offers tremendous growth potential due to its large consumer base, increasing internet penetration, and a thriving digital ecosystem.

The key challenge for startups going forward will be to navigate a more cautious investment landscape. With fewer large deals on the horizon, startups will need to focus on profitability, scalability, and sustainable growth to attract the next wave of venture funding.

India’s startup ecosystem is experiencing a temporary slowdown in funding as venture capital firms adopt a more cautious stance. While some sectors continue to receive significant investment, the trend for the remainder of 2025 suggests a more measured approach to funding in India’s rapidly evolving entrepreneurial landscape.

Key Deals of the Week:

Farmley: $40 million from L Catterton, DSG Consumer Partners, BC Jindal

JSW One Platforms: Rs 340 crore ($39.7 million approx.) from Principal Asset Management, JSW Steel

Nobel Hygiene: Rs 170 crore ($20 million) from Neo Asset Management

Celebal Technologies: $15 million from InCred Growth Partners, Norwest Capital

Flam: $14 million from RTP Global, Dovetail

Hoccoraised: $10 million from Chona Family Office, Sauce VC

Hyperbots: $6.5 million from Arkam Ventures, Kalaari Ventures