Kissht, a Mumbai based fintech startup has chalked out plans to expand the adoption of its new card named Ring. As part of its growth strategy it secured $80 Million in funding round led by Vertex Growth and Brunei Investment Agency.

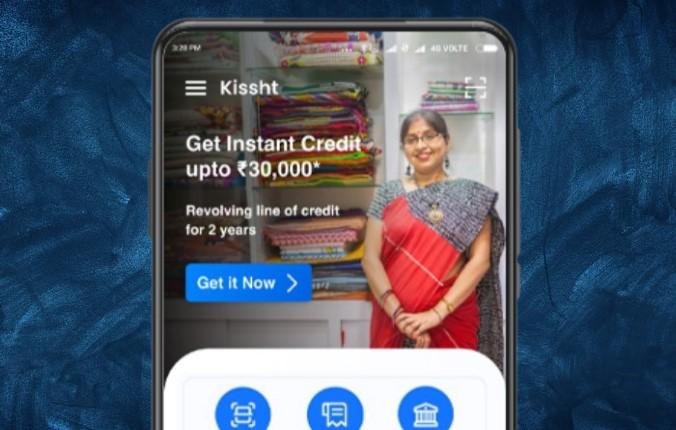

The fresh round of investments will be deployed to accelerate the startup’s growth ambitions in the challenger card segment with Ring. Kissht users can use Ring to avail a line of credit for up to INR 30K, pay for ecommerce transactions, pay to merchants, pay to self and pay to friends.

Kissht plans to issue Ring in association with RBL and SBM Bank to customers linked with a credit line for the millennials and Gen-Z, where credit card penetration is <2%.

Founded in 2015 by former McKinsey consultants Krishnan Vishwanathan and Ranvir Singh, Kissht is a lending tech startup that offers small-ticket loans to users to finance their personal shopping and avail personal loans.

The startup is valuation touch $500 Million

According to the startup’s website, it has 3.5 Mn customers and 500+ online and 3000+ offline partners who provide a line of credit to their shoppers. Kissht is a profitable startup and has an active loan book of INR 900 Cr. According to the startup, it had projected its revenue at INR 500 Cr in FY22 with a profit of INR 50 Cr.

In January 2022, Kissht had announced plans to expand its business to 10 Mn borrowers and to take its total credit volume to INR 10,000 Cr in FY23 (3x higher than FY22).

The round also saw the participation of Vertex Ventures SEA India and Endiya Partners.

Currently, Kissht competes with the likes of Lendingkart, Capital Float, FlexiLoans, and KredX. With the current round and plans to enter the BNPL card segment, it aims to take on startups such as slice, OneCard and UNI, among others.