February 14, 2026: In a significant push to India’s innovation economy, the Union Cabinet has cleared the second edition of the Startup India Fund of Funds FoF 2.0, committing a fresh Rs 10,000 crore corpus to fuel the country’s next wave of entrepreneurship.

The newly approved Startup India FoF 2.0 builds on the momentum of the government’s flagship Startup India initiative, which was launched in 2016 with the goal of turning India into a global startup hub. A decade later, the ecosystem looks dramatically different. From fewer than 500 startups at the time of launch, the country now boasts over two lakh ventures recognised by the Department for Promotion of Industry and Internal Trade (DPIIT), with 2025 marking the highest-ever annual startup registrations.

Startup India Fund of Funds: A Second Act for Venture Capital

FoF 2.0 follows the earlier Fund of Funds for Startups (FFS 1.0), which was introduced to bridge funding gaps and catalyse domestic venture capital. Under that phase, the entire Rs 10,000 crore corpus was committed to 145 Alternative Investment Funds (AIFs). Those funds, in turn, invested over Rs 25,500 crore into more than 1,370 startups spanning sectors such as artificial intelligence, agriculture, clean technology, fintech, healthcare, space technology and biotechnology.

The first round was credited with nurturing first-time founders, crowding in private investment and helping India develop a stronger homegrown venture capital base.

However, as the ecosystem matured, new funding challenges surfaced, particularly for deep tech ventures and capital-intensive manufacturing startups that require longer gestation periods.

Startup India FoF 2.0 to Back Bold Bets in Deep Tech, AI, Space

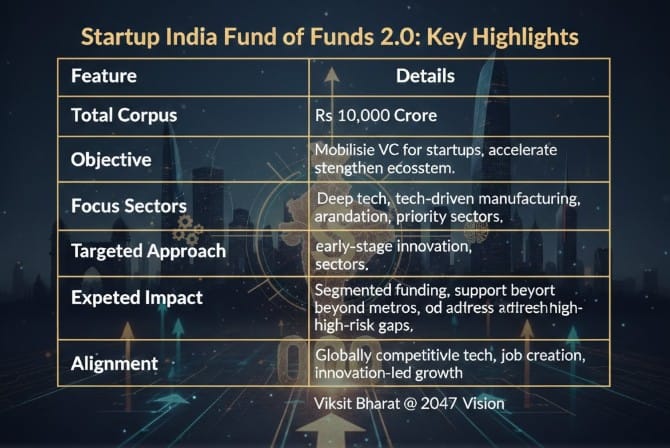

Unlike its predecessor, Startup India Fund of Funds – FoF 2.0 is designed with a sharper lens. The government says the new fund will adopt a more segmented and targeted strategy. Key focus areas include:

- Deep tech and technology-driven manufacturing that demand long-term patient capital

- Early-growth stage founders to curb funding-related startup mortality

- Expanding reach beyond established metro startup hubs

- Addressing capital gaps in high-risk, priority sectors

- Strengthening smaller domestic venture capital funds

Industry observers note that deep tech sectors, including robotics, advanced materials, semiconductor design and space technology, often struggle to secure sustained early backing. By directing capital into such areas, policymakers aim to reduce dependence on foreign funding and improve strategic resilience.

Aligning with the 2047 Vision

Officials have positioned FoF 2.0 as part of the broader Viksit Bharat @ 2047 roadmap, a long-term ambition to transform India into a developed nation by its centenary of independence.

The underlying idea is straightforward: build globally competitive technologies at home, strengthen manufacturing capacity, generate high-value jobs and reinforce India’s standing in emerging sectors.

If the first decade of Startup India was about igniting entrepreneurial energy, the second phase appears focused on consolidation, backing innovation that can endure market cycles and compete internationally.

With Rs 10,000 crore once again on the table, the government is betting that the next generation of founders will not just scale fast, but build deep, in technology, manufacturing and global ambition.