New Unicorn CredAvenue announced that it has raised $137 million in a Series B round of funding, catapulting it to the famed startup unicorn club.

The startup will use the fresh investments to augment on its collection infrastructure. CredAvenue will nearly double the pool of capital for Employee Stock Ownership Plan (ESOP) to Rs 500 crore across two separate programmes, Co-founder and CEO of Chennai-headquartered debt marketplace for enterprises, CredAvenue stated.

“We are currently at 450 employees, 80 percent of whom are covered under the ESOP programme. Going ahead, we would like to extend this to all our employees,” said Gaurav. In February, the company had acquired a majority stake in digital collection solution provider spocto. The fresh capital will also be used to expand Spocto’s international presence beyond Middle East Asia and India organically and inorganically.

New Unicorn CredAvenue Bets Big on Business Intelligence, Data Collection

In a statement, CredAvenue stated, part of this new investment will be used in deep technology innovations, AI, ML, and data analytics. Incorporated in 2021 by Gaurav Kumar and Vineet Sukumar as a subsidiary of financial services marketplace Vivriti Capital,

“By leveraging a next-gen business intelligence and data-collection platform, CredAvenue enables efficient match-making and minimises manual and recurring efforts in underwriting, executing, and monitoring debt,” said Nikhil Sachdev, Managing Director of Insight Partners. He will also join the company board.

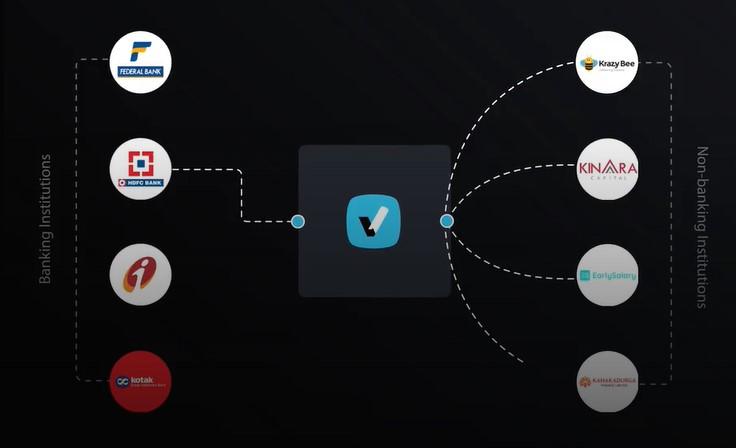

CredAvenue connects enterprises and lenders on its marketplace. It offers multiple product lines including lending and capital solutions for enterprises through CredLoan, co-lending partnerships for banks and NBFCs through CredCoLend, bond issuance and investment for institutional and retail investors through Plutus, supply chain financing solution and end to end securitisation, and portfolio buyouts through CredPool.

The startup claims to work with over 2,300 corporates and connects them to over 750 lenders. It has a loanbook of over Rs 90,000 crore.

The round was, led by Insight Partners, B Capital Group and Dragoneer Investment Group, valued the company at $1.3 billion post-money, a 3X jump from its $410-million valuation in September 2021.

Returning investors also participated in the round. CredAvenue had raised $90 million in its Series A round led by Sequoia Capital, Lightspeed Ventures, TVS Capital and Lightrock.