According to two separate regulatory filings, the Bengaluru-based neobanking platform Fi (whose parent company is epiFi Technologies) has received $15 million from Singapore’s state-owned investment company Temasek Holdings (via V-Sciences Investments Pte Ltd) and $2 million from current investor QCM Holdings.

The fundraising is a part of the startup’s broader Series C round, for which it had previously secured $45 million from current investor Alpha Wave Global (formerly Falcon Edge Capital) in June.

Fi has already raised a total of $137.2 million; their cap table lists investors such as Ribbit Capital, Sequoia Capital, and Eduardo Saverin’s B Capital, among others.

PharmEasy, Licious, UpGrad, Unacademy, Shiprocket, ShareChat, Lenskart, Ola, and more startups are included in Temasek’s portfolio. Zomato, PolicyBazaar, Devyani International, and Cartrade are four of its portfolio companies that were listed on Indian stock exchanges last year.

It’s interesting to note that Temasek has backed Open, another neobanking platform that became a unicorn after a $100 million Series C financing spearheaded by the Singapore company last year.

Additionally, it supports the parent business of the credit card platform OneCard, unicorn fintech FPL Technologies.

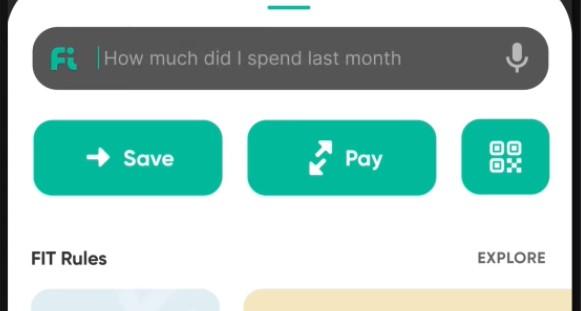

Founded in 2019 by former Google Pay executives Sujith Narayanan and Sumit Gwalani, Fi is a financial app that offers digital bank accounts and financial guidance to working professionals. It offers products such as a zero-balance savings account and helps its users track spending and organise their funds.

It competes with startups like Jupiter, Niyo, P10, and InstantPay in the consumer-focused neobanking space.

In May 2022, Fi announced its foray into new financial services, including mutual fund investments, peer-to-peer (P2P) investments (Fi Jump), and digital lending on its platform, along with other savings products. This would put it in direct competition with various other fintechs in the space.

For P2P lending, Fi has partnered with P2P non-bank Liquiloans

Further, it plans to add new credit products like personal loans, credit cards, and a credit line over the next 12 months, and onboard more banks. At present, Fi provides banking services through a partnership with Federal Bank.

The fundraise comes at a time when digital lending apps and third-party tech providers are grappling with new digital lending rules released by the Reserve Bank of India (RBI).